- #Car loan payment calculator with credit score install

- #Car loan payment calculator with credit score full

- #Car loan payment calculator with credit score registration

Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution (Firm Reference Number: 778488). After you have entered your current information, use the graph options to see how different loan terms or down payments can impact your monthly payment. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Use the Payment Calculator to estimate payment details for your next Ford vehicle Simply select your vehicle, your trim, enter your down payment and. The unique Ray ID for this page is: 812b6489ee4a77b5Ĭomparethe is a trading name of Compare The Market Limited. Please include what you were doing when this page came up and the Ray ID found at the bottom of this page. You can email the site owner to let them know you were blocked. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The action you just performed triggered the security solution. The website is using a security service to protect itself from online attacks. Your monthly payment and overall loan amount decrease based on the amount of your initial cash down payment.Compare the Market - Home Sorry, you have been blocked You are unable to access Why have I been blocked?

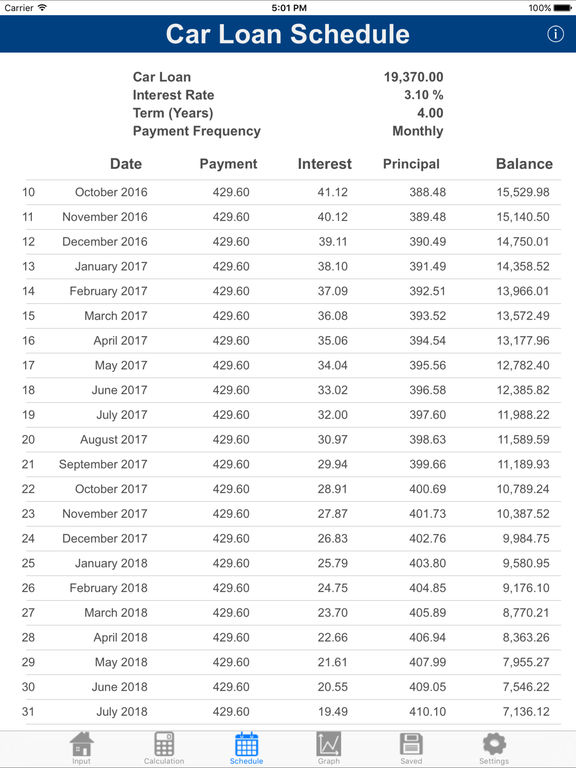

Adjusting this option assists in calculating the value once the vehicle is paid off. Example 2.00 Example 4.00 Monthly Payment: 490.78: Monthly Payment: 515. According to the CRL report, the average car-title borrower renews a loan eight times, paying 2,142 in interest for 951 of credit. Example of an Auto Loan with Different Interest Rates.

#Car loan payment calculator with credit score full

Enjoy the full benefit of your cars trade-in or resale value.

#Car loan payment calculator with credit score install

Modify or repaint the car, or install custom equipment, as you see fit. No mileage limit especially important if you typically drive more than 12,000 to 15,000 miles per year. Vehicle DepreciationNew and used vehicles lose their value. Interest rates on auto title loans are very high often 25 per month - or about 300 per year - according to the Center for Responsible Lending. After your final payment is made, you can drive your Subaru vehicle for years to come.

Trade-In ValueThe amount or value you expect to receive if you are trading in a vehicle.

#Car loan payment calculator with credit score registration

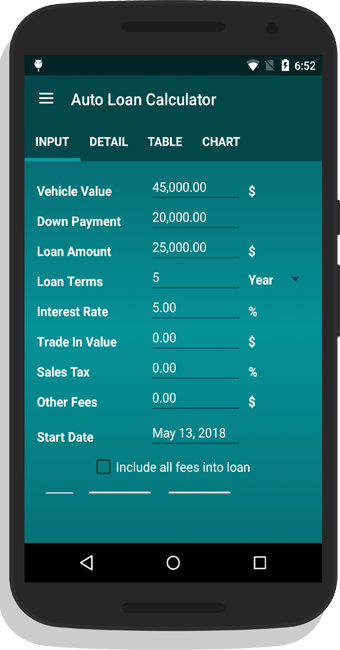

Adding loan terms, interest rates, and any vehicle down payment can help determine the monthly payment. When calculating, including additional information on the purchase price, any manufacturer's rebates, title and registration costs, depreciation, trade-in value, and amount owed on trade-in will help you determine the value of the vehicle. This will help determine the monthly payment and total car cost you can really afford. Generally, a car payment should never exceed 10% of your total income (after taxes). Before applying for your auto loan with TDECU, review your overall financial situation. Are you looking to purchase a car and wondering how much you would pay for your monthly car payment? While a low-interest rate and attractive offer may seem like a no-brainer, it is important that the monthly payment and other expenses of car ownership fit within your budget.

0 kommentar(er)

0 kommentar(er)